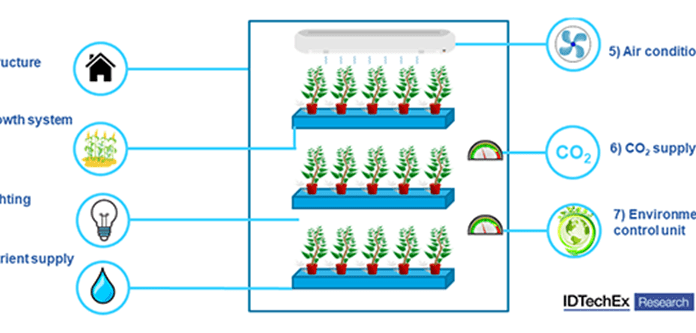

WITH their ability to fully control growing environments through LEDs, sensors, and HVAC systems, vertical farms achieve great control over the quality and consistency of their crop. However, this degree of control comes at a cost, a very literal one. Vertical farms are notoriously power-hungry and require large amounts of energy to operate. These energy costs often form one of, if not the largest part, of their operational expenditure. Even before rising energy prices, many vertical farms have already found it challenging to achieve profitability due to the high costs of operation; with dramatic increases in the cost of energy, this could be the final nail in the coffin for many vertical farms. The IDTechEx report “Vertical Farming 2022-2032” explores the economic and technological factors shaping this rapidly growing industry.

So What Can Be Done?

Over the short term, there is an immediate need for vertical farms to decouple themselves from the price of gas. This could be achieved through increased reliance on renewable energy sources, such as through greater integration of photovoltaics, which may be possible through direct connections to solar farms. Alternatively, local biomass boilers could potentially alleviate energy costs by making use of waste wood generated from manufacturing or maintenance. Increasing the use of renewable energy may require significant capital investment but would provide greater cost efficiencies over the longer term.

Another important task is to reduce energy usage. However, this is difficult; while the efficiency of underlying LED technology has improved significantly since the start of the vertical farming industry, the architecture of current LED semiconductor chips is close to theoretical limits. That is not to say that energy usage cannot be lowered; an alternative approach, as used by Intelligent Growth Systems and Perfand LED, is to periodically modulate energy delivery to lights – as opposed to a constant energy supply. This potentially reduces the average energy consumption without affecting, or possibly even enhancing, crop growth.

Vertical farms may change their strategy to achieve profitability in a challenging economic climate. A common approach today by many vertical farms is to produce low-margin, high-volume crops such as lettuce and microgreens. There are multiple reasons for this, including lowered energy requirements, reduced risks, and faster time to return. However, this strategy also presents challenges. The high costs of vertical farming make achieving price parity with conventional produce difficult. Vertical farms could instead target a completely different market; a major advantage of vertical farming is that it can grow crops that may not be possible through conventional agriculture, especially in cold Western climates. By growing produce inaccessible to traditional agriculture with a focus on flavour, vertical farming could command a further price premium for its products. A particularly noteworthy example would be seen in Oishii: the Omakase strawberries grown by the company are noticeably sweeter than many conventionally farmed counterparts, and these are used as one of the selling points to justify the comparatively higher pricing point. Vertical farms also have opportunities to produce medicinal plants and herbs, along with other similar high-value crops. Such strategies may play well to the strengths of vertical farms and increase the attractiveness of their produce.

To find out more about the IDTechEx report “Vertical Farming 2022-2032”, including downloadable sample pages, please visit www.IDTechEx.com/VertFarm.