Steinhoff on Friday afternoon released its interim results for the six months to end-March 2018.

It suffered an operating loss of €152 million (R2.4 billion) and its revenue declined by 6% to €9.34 billion. It has also written off billions of euros due to suspect accounting and deals.

The company, which is based in Stellenbosch, owns 40 brands in over 30 countries. Apart from a number of SA assets, including the automotive company Unitrans and a stake in Steinhoff African Retail (owner of Pep and Ackermans), it owns furniture groups in Europe, the US mattress giant Mattress Firm (which has 3,000 shops) and the UK retailer Poundland.

The company has been struggling to stay afloat after accounting irregularities emerged in December, which saw its CEO Markus Jooste resign. The police is now investigated fraud at the company, which has lost 98% of its value in seven months.

Its new management warned that is investigation into accounting irregularities has not been completed, and that there may still be “material” revisions. PricewaterhouseCoopers, which is currently conducting a full-scale review, also has not reviewed the results.

So, with those major caveats, here are seven takeaways from Steinhoff’s interim results:

1. It owes much more than it is worth

The company’s current liabilities exceed its assets. It still owes €9.4 billion (compared to its total equity of less than €3.8 billion), and while it on Friday announced an interim agreement with its creditors, a sustainable solution is critical. It had net debt costs of €224m in the first six months of the financial year.

Management still reckons Steinhoff is a “going concern”, given that there is a reasonable prospect that the group will be reschedule its debt repayments, and that legal action against the group will take more than 12 months to resolve. Its share price gained almost 6% to R1,28 on Friday afternoon following the release of the interim results.

2. It has had to write off billions due to suspect accounting and transactions, including property deals

In September 2016, the company reported equity of €16.635 billion. Management now calculates that almost €11bn of equity was overstated, and the value of assets in its 2017 financials was lowered from €34.7bn to €22.3bn.

Steinhoff: Equity for FY17 ‘restated’ by €10.9b as follows:

Opening bal: € 16.6b

Impair goodwill -€ 2.4b

Impair property -€ 1.5b

Other -€ 7.0b

Closing bal: € 5.7b

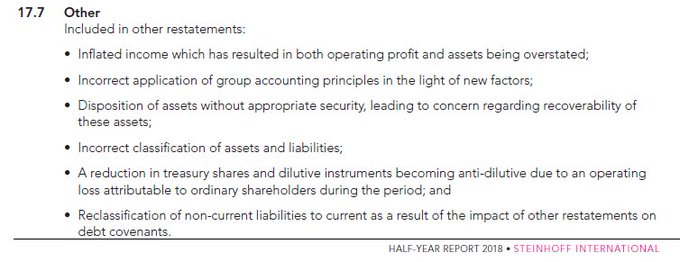

“Other” consists of this litany of horrors:

Profits were overstated and management questioned the accounting treatment of transactions “which appear to not be at arm’s length”. It says that shareholders, subsidiaries and associate companies within the group took part in these deals.

Also, more than €1 billion was written off due to the overvaluation of properties by its Hemisphere property group. The group alleged Hemisphere, which controls the group’s owner-occupied buildings, sold and later repurchased properties at inflated prices.

3. Its US mattress chain made massive losses

Mattress Firm’s total operating loss was €133 million – 66% more than in the same period in the previous year. This was due to costs relating to the rebranding stores and the end of the company’s contract with its largest supplier.

Steinhoff’s operating profit in Europe fell by 85% to only €7 milion. South African revenue grew by 10%, but operating profit fell 8% to €176 million.

4. A Steinhoff subsidiary sold a Gulfstream Jet at an R80 million loss to cover its debt

Rainford Isle of Man Limited, a wholly owned subsidiary of Steinhoff, sold a company jet R206 million ($15.5 million) in January, less than a year after acquiring it for R288 million ($21 million).

5. Steinhoff’s negative reputation is affecting its staff retention rates and sales

Steinhoff expressed concern that the “negative press” it has received influenced consumer behaviour and staff retention rates. Made to order furniture, which has a long lead time, was specifically affected, with consumer apprehension to use the company’s services due to uncertainty about the group’s stability.

The group said its reputational damage has also impaired the group’s ability to retain and attract personnel, once again citing its sustainability as a possible deterrent.

6. Every month, Steinhoff is paying millions to lawyers and auditors

READ: Steinhoff is paying experts R5.4 million a day to sort out its financial mess – and it may get worse

The company said after the “accounting irregularities” were exposed in December, it has spent over €39 million to pay for legal advisers, forensic investigators and external auditing services, of which €28 million was paid for the three months after January 2018.

“The professional fees are expected to increase substantially until such a time as the restructuring plan has been finalised and all other relevant agreements have been concluded,” the company said.

7. Steinhoff doesn’t think it will be delisted

Management said it is in regular contact with regulators in Germany, the Netherlands and SA, where Steinhoff shares are listed, and that none of them are “currently seeking a suspension of its listing”